Setting up a nonprofit chart of accounts for a small charity isn’t just an accounting exercise—it’s the foundation that determines how clearly your mission is reflected in your finances. At Accountix Solutions, we’ve helped countless small charities move from confusing, overstuffed ledgers to clean, mission-aligned charts of accounts that make reporting effortless. In this guide, we’re not just explaining the “how.” We’re sharing the practical structure, common pitfalls, and real-world shortcuts we’ve developed while supporting nonprofits every day. With our day-to-day experience in nonprofit accounting, we’ve seen exactly what works—and what doesn’t. By the end, you’ll know exactly how to build a chart of accounts that strengthens transparency, simplifies audits, and gives your charity the financial clarity it needs to grow with confidence.

Quick Answers

Nonprofit Accounting

Nonprofit accounting tracks how every dollar is received, allocated, and used to advance the mission.

It relies on fund accounting, which separates restricted and unrestricted funds so organizations stay compliant and donor-aligned.

At Accountix Solutions, we’ve seen that clear, transparent financial tracking is the difference between “hoping the numbers add up” and confidently guiding programs, grants, and long-term impact. With our Accounting Services, that clarity becomes a reliable foundation your organization can build on.

The goal isn’t profit—it’s proving stewardship, protecting trust, and enabling smarter decisions backed by clean, audit-ready data.

Top Takeaways

A clean, mission-aligned COA is essential for clarity and compliance.

Keep your chart of accounts simple and tied to real programs and funding.

Always separate restricted and unrestricted funds.

Use clear coding rules and review your COA quarterly.

A well-designed COA strengthens donor trust and long-term financial stability.

Why a Chart of Accounts Matters for Small Charities

A well-structured nonprofit chart of accounts (COA) ensures every transaction is categorized in a way that reflects your mission, funding sources, and compliance needs. For small charities, this structure prevents confusion, simplifies donor reporting, and supports accurate budgeting and grant tracking—much like the clarity frameworks often used by Small Businesses to stay organized and financially accountable.

Key Components of a Nonprofit Chart of Accounts

A standard nonprofit COA includes several core categories:

Assets – Cash, receivables, prepaid expenses, and equipment.

Liabilities – Accounts payable, credit cards, loans, and deferred revenue.

Net Assets – Unrestricted, temporarily restricted, and permanently restricted funds.

Revenue – Donations, grants, program revenue, fundraising income, and in-kind contributions.

Expenses – Program services, management and general, and fundraising costs.

Organizing your accounts using these buckets ensures clear reporting and compliance with nonprofit accounting standards.

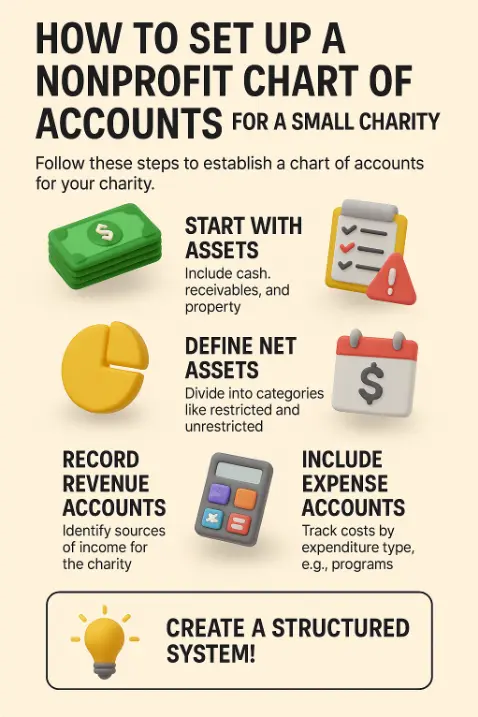

Steps to Set Up a Chart of Accounts for a Small Charity

Review your organization’s activities. Identify how you receive funding, how you spend money, and what reporting obligations you must meet (e.g., grants, board reporting).

Map your financial flow. Create accounts that mirror your real-world processes—donation types, programs, events, grants, and operational needs.

Keep it simple. Start with a lean structure. Small charities don’t need dozens of accounts; use broad categories and expand only when necessary.

Integrate restrictions. Clearly separate restricted and unrestricted funds so you can track how each dollar must be used.

Align with your accounting software. Whether using QuickBooks, Xero, or another platform, ensure your COA layout works smoothly with built-in nonprofit reporting features.

Document everything. Create a COA guide that defines how each account is used so your team stays consistent as you grow.

Common Mistakes Small Charities Should Avoid

Creating too many accounts and overwhelming the system

Mixing restricted and unrestricted funds

Using inconsistent naming conventions

Skipping board or accountant input during setup

Avoiding these pitfalls keeps your reporting clean and eliminates confusion during audits.

The Payoff: Clarity, Compliance, and Confidence

When structured correctly, a nonprofit chart of accounts becomes more than a list of numbers—it becomes a roadmap for decision-making. Small charities gain clearer insights into program impact, donor activity, and financial stability, enabling better planning and stronger accountability. With the support of Outsourced Accounting, these insights become even more accessible, helping organizations interpret data accurately and make informed choices.

“Small charities don’t need a complicated chart of accounts; they need one that reflects how they actually operate. After years of cleaning up nonprofit books, we’ve learned that clarity beats complexity every time. When your accounts mirror your mission and your daily workflows, reporting becomes effortless, audits run smoother, and your team gains the confidence to make better financial decisions—especially when your accounting setup is built for simplicity and alignment.”

Essential Resources to Strengthen Your Nonprofit Accounting Foundation

At Accountix Solutions, we know that the right guidance can save small charities countless hours of trial and error. These curated resources reflect the tools and insights we often recommend to nonprofits looking to build a cleaner, more confident financial system.

1. NetSuite – A Clear Starting Point for Understanding Nonprofit Accounting

NetSuite breaks down nonprofit accounting in a way that removes the intimidation factor. It’s an excellent place to begin if you want a straightforward explanation of fund accounting and the structure behind a well-organized chart of accounts.

2. Aplos – A Practical Chart of Accounts Template You Can Use Immediately

Aplos provides a clean, ready-to-apply COA template that mirrors the structure many small nonprofits need. We often see teams make faster progress when they begin with a framework like this instead of building everything from scratch.

Source: https://www.aplos.com/academy/nonprofit-chart-of-accounts

3. Nonprofit Financial Commons (Jitasa) – Clear Guidance on Fund Restrictions and COA Design

This resource offers a helpful perspective on organizing your accounts around donor restrictions and grant requirements. It’s especially valuable for small charities managing their first restricted funds.

Source: https://nonprofitfinancials.org/resources/establishing-a-nonprofit-chart-of-accounts

4. Sage – Strategic Best Practices for Long-Term Accounting Health

Sage’s guide goes beyond the basics and highlights the financial practices that support stability as a nonprofit grows. We appreciate how it blends compliance considerations with day-to-day operational guidance.

Source: https://www.sage.com/en-us/blog/best-practices-in-nonprofit-accounting-a-complete-guide

5. The Charity CFO – A Hands-On Template with Real-World Implementation Advice

This practical resource includes both a chart of accounts template and a walkthrough of how to implement it effectively. It mirrors many of the conversations we have with small nonprofits during cleanup or system rebuilds.

Source: https://thecharitycfo.com/how-to-set-up-a-nonprofit-chart-of-accounts

6. Your Part-Time Controller (YPTC) – A Straightforward Look at Account Numbering & Structure

YPTC offers one of the clearest explanations of how to number and categorize accounts. For small teams trying to keep their books clean and consistent, this clarity makes a noticeable difference.

Source: https://www.yptc.com/understanding-nonprofit-chart-of-accounts

7. PwC – Compliance-Driven Standards Every Nonprofit Should Be Aware Of

PwC provides authoritative updates on nonprofit accounting rules and reporting standards. We often point organizations here when they’re preparing for audits or looking to strengthen their compliance foundation.

Source: https://www.pwc.com/us/en/industries/health-industries/library/nonprofit-accounting-standards.html

Supporting Statistics That Reinforce the Need for a Strong Nonprofit COA

1. Nonprofits support 12.8 million U.S. jobs

Represents 9.9% of all private-sector jobs.

From our experience: payroll is often a nonprofit’s largest expense.

A clear COA ensures wages, benefits, and program labor costs are coded correctly for budgeting and grant reporting.

2. Over 300,000 nonprofit establishments operate in the U.S.

The sector is large—and diverse.

Small charities often struggle most with inconsistent bookkeeping.

A clean COA early on helps prevent errors and makes audits far smoother.

Source: https://www.bls.gov/bdm/nonprofits/nonprofits.htm

3. National nonprofit data provides vital financial benchmarks

Reliable government data helps nonprofits gauge scale and growth.

Aligning your COA with sector-wide standards boosts credibility.

We’ve seen stronger donor and auditor confidence when financials mirror these best-practice categories.

Source: https://www.bls.gov/bdm/nonprofits/nonprofits.htm

Final Thought & Opinion

A strong nonprofit chart of accounts isn’t just bookkeeping—it’s a foundational tool that shapes clarity, accountability, and growth. After years of helping nonprofits rebuild and streamline their financial systems, we’ve seen one pattern consistently—much like what we observe when supporting Marketing Companies with financial organization: the right structure always leads to better decisions, smoother operations, and scalable growth.

The organizations that invest early in a clean, mission-aligned COA are the ones that operate with far more confidence later.

Why It Matters for Small Charities

Small nonprofits often believe they’re “too small” to need structure, but our firsthand experience shows the opposite:

Every dollar has a purpose.

Grant and donor reporting depends on accuracy.

Restricted funds require clean separation and tracking.

A well-designed COA helps ensure all of that happens without confusion or rework.

What We’ve Learned at Accountix Solutions

From years of nonprofit cleanups and audit prep, one insight stands out:

A thoughtful COA becomes a strategic asset.

It simplifies decision-making.

It strengthens donor and auditor trust.

It keeps your team organized and audit-ready year-round.

The Bottom Line

When your chart of accounts reflects the true structure of your mission and operations, your nonprofit is better equipped to grow sustainably, communicate impact clearly, and manage finances with confidence—just as Marketing Companies benefit when their financial structure aligns with how they operate and deliver results.

Next Steps

Follow these quick, actionable steps to start building a clean, effective chart of accounts for your nonprofit:

Review your current setup

Look for duplicate, unclear, or unused accounts.

Note where confusion or bottlenecks happen.

List your programs and funding sources

Include grants, donations, and restricted vs. unrestricted funds.

Identify which items need dedicated accounts.

Start with a lean nonprofit COA template

Use only the accounts you need right now.

Avoid overbuilding.

Separate restricted and unrestricted funds

Create clear categories for each.

Helps avoid compliance and reporting issues.

Align the COA with your accounting software

Check numbering, categories, and reporting formats.

Ensure everything maps cleanly.

Document basic coding rules

Write simple guidelines for how to use each account.

Keeps your team consistent.

Review quarterly

Update as programs, grants, and revenue evolve.

Make small fixes before they become major cleanups.

If you want, I can turn this into a downloadable checklist, PDF, or quick-reference guide.

FAQ on Nonprofit Accounting

Q: What is nonprofit accounting?

A:

Tracks donations, grants, and program spending.

Ensures compliance and transparency.

Helps donors see exactly where money goes.

Q: How is nonprofit accounting different from for-profit accounting?

A:

Uses fund accounting.

Separates restricted vs. unrestricted funds.

Prevents misuse of donor-designated money.

Q: Why is fund accounting important?

A:

Builds donor trust.

Protects the organization from compliance issues.

Ensures funds are used as promised.

Q: What financial statements do nonprofits need?

A:

Statement of Financial Position

Statement of Activities

Statement of Cash Flows

Statement of Functional Expenses

Q: Do nonprofits need a dedicated accountant or system?

A:

Yes—clean records reduce audit stress.

Supports accurate reporting for boards and funders.

Enables informed decision-making.